All Stamping Metals

Plastic Overmolded Big Head Bolts

Precision in Polymers: Unveiling the World of CNC Machining Plastic

From Design to Delivery: The Journey of Flourish Legend's CNC Appliance Parts

Precision Engineering in Healthcare: Flourish Legend's CNC Machining Medical Parts

Home Appliance Molding Service

Vacuum Casting vs Injection Molding

Top 5 CNC Prototyping Service Providers

Is Titanium Hard to Machine

What is PTFE Plastic?

What Is Vacuum Casting Process?

Is Titanium Easy to Machine

Mastering the Science of Titanium: How Our Machining Titanium Feeds & Speeds Expertise Elevates Your Precision Parts?

How to Identify the Best Stainless Steel Stamping Parts Suppliers for Your Manufacturing Needs?

How to Stamp Aluminum?

How to Calculate CNC Prototyping Cost?

Vacuum Casting vs Vacuum Forming: How to Choose the Right Prototyping Method?

The Evolution of ABS Plastic Machining: Precision Meets Performance

CNC Milling ABS Plastic: Accelerating Innovation in Product Development

How Does MC Nylon Compare to Delrin in CNC Applications?

What Are the Latest Trends in Brass Stamping for 2025?

How Can Brass Stamping Parts Enhance Your Product Design?

What is the CNC Machine

What is PTFE Used For

Prototyping Stainless Steel Parts: Should You Choose a CNC Robot Router or a Machining Center?

Nylon vs Polycarbonate: Which One Should You Choose for Precision Parts?

MIG vs TIG: Which One Should You Choose for Thin Sheet Metal Welding?

Automotive Sheet Metal Repair with MIG Welding: A Practical Guide from Rust Removal to Final Grinding

What Is Stamped Stainless Steel?

Home

Automobile & Transportation

CNC Machining Plastics

Flourish Legend CNC Machining Services

Prototyping

Blog

Common Problems and Solutions in Sheet Metal Machining

CNC Machining ABS

Plastic Injection Molding Materials

All Sheet Metals

Beauty Apparatus Plastic Case

High-Precision Aluminum Alloy Two-Way Connection Handle

Wooden Watch Box

Rust Removal Robot Spare Parts

Stainless Steel Water Pipe Fittings

Stainless Steel Nut Parts

Stainless Steel Bolt

Stainless Steel Machine Taps

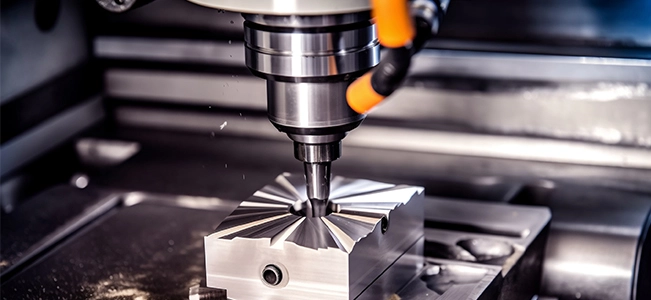

Video of 5-axis CNC Machining Process

Home Appliance Industry

FAQ

CNC Machining Metals

Flourish Legend Custom Injection Molding Services

CNC Machining

How to Calculate Mold Shrinkage for Plastic Molds?

CNC Machining PC

Electrolyte Analyzer Plastic Housing

High-Precision Aluminum Alloy Cross Connection Handle

Plastic Remote Control Case

Materials

Services

Robotic Industry

Injection Molding Materials

Injection Molds & Molding

CNC Machining PMMA (Acrylic)

Temperature Contoller Plastic Housing

Precision CNC Turning Service

Injection Molds

How is a Metal Mould Created for a Silicone Rubber Mould?

High-Precision Aluminum Alloy Seat Armrest

Plastic Landline Phone Button

Flourish Legend Rapid Prototyping Services

Application

Video

Flourish Legend Custom Sheet Metal Machining Services

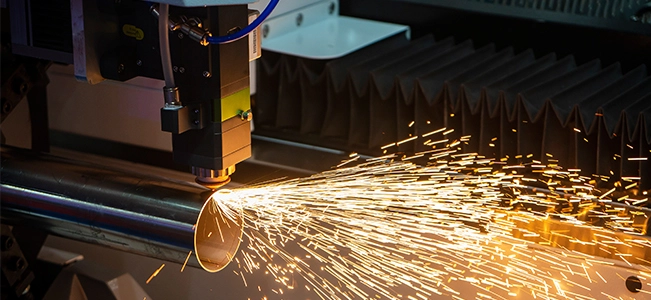

Sheet Metal Fabrication Services

Sheet Metal Materials

CNC Machining POM (Delrin/Acetal)

Smart Multi-Display Medical Equipment Shell

CNC Milling

CNC Prototyping Service

Sheet Metal Forming

Aluminum Stamping

How Much Does CNC Process a Part Cost?

Plastic Lumbar Support

Plastic Phone Holder

Injection Molding Service

Resources

Electronic Industry

Medical Equipment Industry

Metal Stamping Service

Stamping Materials

Printer Plastic Housing 1

Vacuum Casting Service

Sheet Metal Stamping

Stainless Steel Stamping

CNC Machining Nylon

Analysis of the Development Trend and Market Status of China's CNC Machine Tool Industry in 2023!

What are the Technical Applications of CNC Machine Tools?

Trash Can Plastic Shell

Aluminum Alloy High-Speed Rail Luggage Rack

Plastic Wireless Remote Control Key Shell

Flourish Legend Custom Metal Stamping Services

Company

About Flourish Legend

CNC Machining MC Nylon

Multifunctional Beauty Instrument Plastic Shell

Industrial Design

Sheet Metal Press Die

Gold Stamping

Do You Know the Basic Composition of CNC Machine Tools?

Industrial Equipment

Storage Basket Plastic Case

Titanium Pipe Parts

Plastic Gamepad Shell

About Flourish Legend

CNC Machining PVC

CNC Machining Aluminium

Printer Plastic Housing 2

5 Axis CNC Machining Service

Sheet Metal Welding

Brass Stamping

Processing Characteristics of Milling, Summary of 17 Key Points of Milling

Custom Made Fasteners

Washing Dishes Plastic Shell

Plastic Sanitation Handlebar

Company News

CNC Machining PEEK

CNC Machining Stainless Steel

Exhalation Resistance

CNC Bending Services

Silver Stamping

How Do You Calculate the Amount of Melt Glue of an Injection Molding Machine?

Electronic Blender Plastic Shell

Plastic Airfield Damper Housing

Plastic Electronic Painting Board

Industry News

CNC Machining Tool Steels

Expiration Knob

CNC Grinding Service

Copper Stamping

CNC Machining PTFE

What is the Difference Between a High-Speed Injection Molding Machine and an Ordinary Injection Molding Machine?

Hair Dryer Plastic Shell

Air Conditioner Air Outlet Plastic Parts

Plastic Multifunctional Audio Enclosure

Inspiratory Knob Extension

CNC Machining Mild Steels

What are Computer Numerical Control (CNC) Milling Machines?

Shower Head Plastic Shell

Plastic Headlight Housing

Plastic Circuit Board Housing

CNC Machining Titanium

Medical Equipment Plastic Pulley

What are the Types of Plastic Pallet Moulds?

Coffe Machine Plastic Shell

Plastic Bumper Cover

CNC Machining Copper

You Don't Know the Development History of ''Central CNC Lathe'' In China!

What will Happen to the Hydraulic Oil of the Injection Molding Machine and How to Fix it?

Smart Dishwasher Stainless Housing

Stainless Medical Cart

Plastic Engine Bracket

Plastic SLR Camera Front Case

What is a CNC Machine Tool?

Toy Car Plastic Shell

Aluminum Parts

Plastic Engine Exhaust Pipe Housing

Why is the Product Produced by an Injection Molding Machine Very Soft?

Plastic Door Lock Button

Plastic Watch Strap

How to Solve the Porosity Problem in the Production Process of Extrusion Blow Molding Machine?

Plastic Gearbox Housing

Aluminum USB Charging Cable Head 1

Contact Us

Why did the Overseas Mergers and Acquisitions Boom in the CNC Machine Tool Industry Gradually Calm Down?

Plastic Engine Housing

Aluminum USB Charging Cable Head 2

Search Result

Sheet Metal Processing Procedures and Processing Precautions!

Rubber Tires

Copper Wire Household Socket Built-In Connecting Wire

Sitemap

Seven Tips for Mold Processing to Reduce Defects!

Plastic Headlight Inner Shell

Household Copper Socket Plug

404

Flourish Legend Teaches You the Control Software of CNC System and its Working Process

CNC Processing Pays Attention to These Four Items, so that You Can Reduce Loss

Plastic Engine Housing 1

Stainless Steel Laptop Cooler Back Cover

Privacy Policy

Flourish Legend Teaches You the Precautions of CNC Programming

How to Choose a More Suitable Industrial Dehumidification Dryer for Injection Molding?

Plastic Engine Housing 2

Stainless Steel Connector UK50N

Submission Successful!

The First Choice for CNC Product Spare Parts Processing Enterprises-Flourish Legend

Exhaust Pipe Connector

Steel Round Watch Case

The Essential Guide to ABS Milling: Materials, Methods, and More

Taggg

Why so Many People Like Flourish Legend CNC Processing Services?

Aluminum Alloy Bus Handlebar

Rectangular Stainless Steel Watch Case

ABS Milling Techniques: Creating High-Quality Plastic Parts

Search Result Products

Exploring Flourish Legend's ''Intelligent Manufacturing in China'' Road

Aluminum Alloy Radiator

Rose Gold Stainless Steel Watch Case

Unleashing Precision: CNC Machining ABS for Superior Parts

Search Result Others

How to Find a Chinese CNC Factory for Cooperation?

Desktop Computer Aluminum Alloy Radiator Shell

From Design to Reality: CNC Machining ABS for Prototyping

Flourish Teaches You EDM Mirror Electric Discharge Mold Processing Technology, Learn to Become an Expert!

Desktop Computer Stainless Steel Case Shell 1

Ptfe CNC Machining: A Comprehensive Guide

[Dry Goods] Detailed Interpretation of Flourish Legend CNC Machining Center Program G Code and M Code Interpretation.

Desktop Computer Stainless Steel Case Shell 2

Mastering Precision: The CNC Machining Plastic Advantage

【Industry Information】It Is Said That the Five-Axis Machining Center Is Good. Flourish Legend Will Take You to Explore the Advantages of Five-Axis Mac

Engineering Dipstick

Desktop Computer Stainless Steel Case Shell 3

Unveiling the World of Mold Making Materials

Industrial Equipment Gear

Crafting Excellence: Exploring the World of Sheet Metal Custom Fabrication

Industrial Equipment Supports

What is Precision Medical Machining?

Most Popular CNC Machining Parts Manufacturers and Suppliers in China in 2023-Flourish Legend

Stainless Steel CNC Machine Tool Equipment Parts

Desktop Computer Aluminum Speaker Body

Shaping the Future: The Dynamics of CNC Laser Metal

Plastic Tool Case

Aluminum Alloy HDMI Terminal

ABS Plastic Unveiled: A Comprehensive ABS Plastic Information to Properties, Applications, and More

Flourish Legend Teaches You the Most Common Injection Molding Processes in 2023

Aluminum Alloy Motor Housing

The Role of ABS CNC Machining in Prototyping

Unveiling the Profound Benefits of Peek CNC Machining in Advanced Manufacturing

In 2023, China's Mainstream Manufacturing Factories Will Lead the World in Processing and Manufacturing of Flourish Legend CNC

Key Factors to Consider When Purchasing an ABS Milling Machine

Flourish Legend Teaches You Four Things to Pay Attention to in CNC Processing

Safety Measures for Nylon Milling Operations

Factors Affecting Quality and Precision in PMMA Machining

Machining Polycarbonate vs Acrylic

CNC Machining vs Injection Molding

Machining Titanium vs Stainless Steel

How Does Injection Moulding Work?

What Materials Can Be Injection Molded?

What Is Stamping Process in Sheet Metal?

5 Tips for Machining Thin Polycarbonate Sheets

The Ultimate Sheet Metal Fabrication Guide: Materials, Processes, and Cost Optimization Tips

Maximizing CNC Copper Machining Efficiency: Material Selection, Tooling & Best Practices

How to Achieve Flawless Results with CNC Plasma Cutting Stainless Steel

How to Machine Delrin? How to Avoid Common Mistakes When Machining Delrin on a CNC?

Performance and Applications of Processed Polycarbonate Sheets

Why Choose Flourish Legend Custom Brass Stampings?

Why Is It Better to Choose Chinese Suppliers for ABS Precision Machining?

Advantages of Plastic Gearbox Housing

CNC Machining vs Injection Molding: How to Choose the Right Process

How Material Choice Affects Plastic Injection Molding Price?

Is Titanium Difficult to Machine? Insights from a CNC Expert

How Do I Choose a CNC Machining Titanium Manufacturer for My Business?

Custom Titanium Fasteners: 5 Must-Ask Questions Before Ordering

What Is MC Nylon and Why Use It for CNC Machining?

How to MIG Weld Thin Sheet Metal Without Burn-Through: Push Technique + Stitch Welding Explained

Prototyping

CNC Machining

Injection Molds & Molding

Sheet Metal Fabrication Services

Metal Stamping Service

CLOSE

Search

English

English  中文

中文  日本語

日本語  한국어

한국어